Johns Hopkins UniversityEst. 1876

America’s First Research University

Buy Buttons Revisited

In March, I wrote about Amazon Buy Buttons and how we had started noticing used copies pushed as the first buying option. This has also been noticed by other publishers in the book industry, with Publishers Weekly, Shelf Awareness, The Huffington Post, The New Republic, Publishing Perspective, Vox, Cnet, and others covering the story.

Amazon has always offered used copies for sale, so what is different?

Buy Button Changes

Until March, buy buttons for in-print and available titles defaulted to buying options where the books were sourced from the publisher – directly or indirectly (meaning new copies sourced from a distributor or a wholesaler). Publishers provided Amazon with a discount, with Amazon and publishers hopefully each making a profit, from which the publisher paid the author(s) royalties.

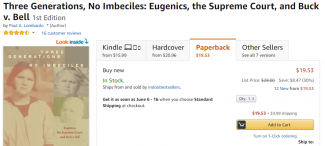

Note in the example above that the new copy “ships from and [is] sold by Amazon.com.” Used copies (of this very new book) are available, but you have to go to the used copy options to see them.

Now when you search Amazon for a title, the buy box may first show the book for sale from another vendor or from an individual selling a used copy. These books could be new and from a wholesaler or internet vendor, or they could be review/exam/desk copies, hurt books (damaged copies), or used copies the seller no longer wants.

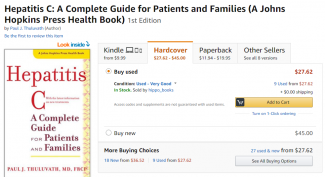

In the example below, the book is being sold by “indoobestsellers.” This company, also known as Websew.com, Inc, is an internet retailer that has been in business since 2000. They buy direct from JHUP. Chances are they offered a better price and won the buy button. It is worth noting that free and prime shipping aren’t offered in this example. The way the page is organized implies this is the only buying option for the paperback edition, but we have this title in stock and ready to ship to Amazon.

What is more distressing for authors and publishers is seeing the buy button given to used copies – especially when the book is in print and in stock.

I have spoken to someone at Amazon who indicated that buy buttons should only be lost to new books, not used books. She asked for examples, which I provided. I have not yet heard back. It seems this new strategy is not complete or conclusive. Again, to the average consumer, this used copy is what is available.

Winning to Lose

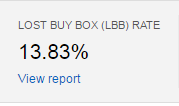

Why are buy buttons lost? Amazon provides reporting indicating why, and the two most common reasons are price and availability. If another vendor has the book in stock and will sell it for a lower price, that vendor can win the button. It would be an anti-trust violation (and unethical) to lower a price for one account to win back the buy button. From my analysis, only a small percentage of the books on the lost buy button report are out of print or out of stock indefinitely.

So while Amazon also tells you how many books are losing their buy buttons and why, they do not offer concrete solutions for “winning” the buy button back. Or rather, they haven’t yet, and no matter what solution they propose, it is unlikely to favor publishers.

New vs. Used

Amazon claims this change only affects “new” books. Obviously, that’s not accurate. What isn’t obvious is that new could mean used and used could mean new. Vendors are deciding the condition of the books. It is likely that hurt books and books never meant for resale are being listed as new. I have asked my contact at Amazon if advertising books as new could be limited to stock coming from wholesalers, established retailers, and publishers to attempt to limit copies being sold as new that are in fact hurts, remainders, used books, and review/exam/desk copies.

Where it Hurts

Revenue for most publishers is split between frontlist (new books) and backlist (older titles). The lifespan of frontlist titles is unknown, but with proven backlist, books could sell steadily for decades. For JHUP, frontlist titles tend to make up about 30% of our revenue with the balance in backlist. In a given year, we may have sales of 160 frontlist books and 3000 backlist books, so the backlist is critical.When I reviewed the lost buy box report, frontlist and fast-selling titles were not as affected. That makes sense – those books are good candidates for Amazon Prime, free shipping, and fast delivery. The backlist on the other hand has a slow but stable sales pace and those sales could go to other vendors without much disruption to the consumer. Amazon still makes a decent profit on the Marketplace sales, but they don’t need to hold inventory on slower moving products. The loss of critical backlist sales could be incredibly damaging to authors and publishers.

This is all still unfolding. We’ll provide additional updates as they occur.

Davida G. Breier, Manager of HFS, worked at two book distributors prior to joining JHUP in 2010. She also sits on the board of No Voice Unheard, a non-profit publisher, and was a contributing writer and photographer for the book Ninety-Five: Meeting America’s Farmed Animals.