Johns Hopkins UniversityEst. 1876

America’s First Research University

Five Reasons Not to Read Days of Slaughter

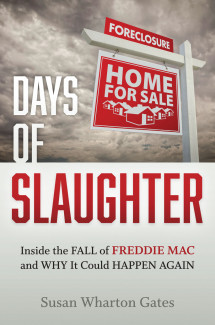

After 19 years at Freddie Mac, I have an insider’s perspective on the housing crisis of 2008. So I wrote a book about it: Days of Slaughter: Inside the Fall of Freddie Mac and Why It Could Happen Again. Here’s why you shouldn’t read it.

- You totally think Freddie Mac and Fannie Mae are to blame for the financial crisis. Known as spongy government conduits, the two firms abided in a murky world where they could “privatize the profits and socialize the losses.” Operating under the cover of expanding the American dream of homeownership, the firms are a colossal example of failed government policy. With their out-sized profits and political cronies, Fannie and Freddie are clearly to blame.

- You totally think Wall Street firms are to blame. Greedy unregulated investment banks sent shady subprime brokers out to trap unsuspecting borrowers. Then they fed

- You are sure the Great Recession could never happen again. Foreclosures have run their course, house prices have pretty much come back, everyone learned their lesson and gosh, all those new regulations must have fixed all the problems. The GSEs are making money again, so why raise alarm?

- You think public policy is dry and boring. Talk about tedious. You want to read something about real people.

- You don’t want to get angry. You spent your spleen back in 2008. You’re over it.

On the other hand, if you think the “who dunnit” story could be more complicated than a sound bite; you are willing to look deeper at the ideological faultlines running beneath the US housing market; you’d appreciate hearing from an insider who has some untold stories to tell; and you worry that things aren’t really back to normal, this book is for you.

Here’s why I wrote Days of Slaughter:

- To add to the public’s understanding about the causes of the crisis, particularly about the role of Freddie Mac and Fannie Mae. Having spent 19 years watching Freddie Mac’s struggle to balance government mandates and shareholder capitalism, I argue that simple answers are not that simple. The answer is yes, the GSEs failed in their mission, and yes, Wall Street banks took advantage of their unregulated status. What you need to know is why and how that happened.

- To jumpstart reform efforts. In 2008, the government essentially nationalized Freddie Mac and Fannie Mae to forestall their collapse. The 2010 Dodd-Frank reform act added a lot of regulations on lenders, but Congress has done comparatively nothing to reform the two firms, which (together with taxpayers) now shoulder more of the nation’s mortgage risk than ever before. If Congress continues to drag its feet, a little-known Cinderella provision will kick in at the end of 2017 reducing the firms’ capital cushions to zero. Time to get a move on.

- To own up. Everybody deserves an explanation and an unofficial apology for what went wrong. It bothers me that no investor, no lender, and no industry or housing trade group did that. I hope Days of Slaughter explains to America’s homeowners what happened to the “greatest housing finance system” in the world—and to them as well.

Susan Wharton Gates, the founder of the Wharton Policy Group, LLC, teaches at Virginia Tech’s Center for Public Administration and Policy and the Pamplin School of Business. She is also a capstone advisor for Georgetown University’s Master of Professional Studies in Real Estate program. Her latest book, Days of Slaughter: Inside the Fall of Freddie Mac and Why It Could Happen Again, is available now.