Johns Hopkins UniversityEst. 1876

America’s First Research University

The Perils of Overpromising: Boosterism in the twenties and now

This post is part of our July “Unexpected America” blog series, focused on intriguing or surprising American history research from 1776 to today. Check back with us all month to see what new scholarship our authors have to share! (Photo Credit Nicholas Raymond)

The turmoil in the Republican Party in the United States and in the United Kingdom following the Brexit vote to leave the European Union has cast doubt on the policies of free trade and globalization. These tensions also mirror some of the patterns evident in response to the New Economy of the 1920s and the Great Depression of the 1930s. Even before the Brexit vote, Mike Dolan wrote that “Global investors are once again dusting off studies of the 1930s as fears of protectionism, nationalism and a retreat of globalization” spread. [Mike Dolan, “Nervy global investors revisit the 1930s playbook,” Reuters June 22, 2016 (http://www.reuters.com/article/us-global-economy-investors-analysis-idUSKCN0Z80ES)] Reporting on a recent study by Morgan Stanley economists, Enda Curran wrote that “To understand today’s global economy, look back 80 years. Just like in the 1930s, growth is being constrained by companies unwilling to spend, falling inflation expectations and governments backing away from fiscal stimulus.” [Enda Curran “The World Economy Looks a Bit like It’s the 1930s,” Bloomberg, June 16, 2016 (http://www.bloomberg.com/news/articles/2016-06-16/world-economy-flashes-hint-of-1937-38-redux-says-morgan-stanley)] During the 1930s it is easy to find victims of a poor economy, but before that not everyone won in the New Era economy of the twenties, regardless of the bullish promises of boosters and technocrats. Similarly, the bullish promises of globalization and free trade have not included all, and those who were left behind have demonstrated their discontent at the ballot.

It is worthwhile to place the Great Depression in historical context. The Stock Market Crash of 1929 signaled for many people the beginning of the Great Depression. Academics point out that many factors contributed to the Depression and that the Crash did not plunge the economy into depression. This, however, is easier to see in retrospect than while people panicked amid bank runs. Still, it is interesting to look at how the Crash contributed to the mass psychology and politics of the 1930s. To do that, we need to understand that the Crash punctured the promises of the New Era economy. The 1920s were a golden age for Wall Street with the stock market seemingly on a never-ending climb. Radio, the hot technology, would bring people together in a common culture. Young people flooded into cities, where youth culture promised opportunity and excitement. Consumers bought exciting new experiences and goods. Boosters promised a bright future that would break the old patterns of economic ups and downs. Journalists and politicians celebrated bankers and stock brokers as the makers of the new economy while largely ignoring those who didn’t participate in the benefits. Much of this boosterism was couched in promises of easy wealth and technocratic jargon.

Part of the issue then is that, like today, advocates for the new downplay the negatives and place faith in technocratic solutions that can neglect the social and cultural change that comes with economic change. Some people are unsettled by change regardless of the economic outcome. During the 1920s, New Era boosters promised a great deal. When the market crashed, not only did it destroy value it also undermined the faith in the boosters’ promises and seemed to vindicate critics of the New Era – those who had not participated in the prosperity or found themselves displaced. We’re now seeing a similar movement evolve with globalization. The United Kingdom has voted to leave the European Union. In the United States, the Republican Party has been captured by a populist uprising. The 1920s and 30s had movements similar to these. In the United States voters supported strict new immigration laws and prohibition, and groups like the Ku Klux Klan attracted white Americans threatened by modernization.

It wasn’t that long ago that proponents of globalization promised that this new, interconnected world would be great. You can see this on the European Commission’s web page, which explains globalization with the statement: “Rising international economic integration, or globalisation as it is commonly known, offers many opportunities. EU firms receive easier access to new and expanding markets and sources of finance and technology. EU consumers receive access to a larger variety of goods at lower prices. This opens the prospect of potential significant gains for the Union in terms of higher levels of productivity and real wages.” [European Commission, “Globalization,”http://ec.europa.eu/economy_finance/international/globalisation/index_en.htm]. While the globalized world is great for some, history also teaches us that we should look beyond the boosterism for a more complete understanding of reality.

When Herbert Hoover accepted the Republican Party’s nomination in 1928 he fully embraced New Era boosterism, going so far as to promise “a final triumph over poverty.” The Great Engineer promised a “technocratic” approach to politics that featured the technocratic skill, rationality, and efficiency that had made the twenties roar. This, of course, proved ironic and deeply out of touch. [http://millercenter.org/president/biography/hoover-campaigns-and-elections] In his memoirs, former President Herbert Hoover blamed Europe for the Great Depression. In Hoover’s estimation, the international financial system put into place by the Treaty of Versailles had laid the groundwork for economic collapse of the 1930s. Hoover didn’t reconsider the political shortcomings of his approach to the economy. Perhaps, looking back at this moment, we’ll blame Brexit for an economic calamity. Perhaps we won’t. But it is worth remembering that the promises of boosters and technocrats don’t always mean much to the people who are not participating in the New Era.

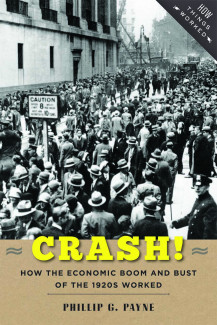

Phillip G. Payne is a professor of history at St. Bonaventure University. He is the author of Dead Last: The Public Memory of Warren G. Harding’s Scandalous Legacy. His latest book is Crash!: How the Economic Boom and Bust of the 1920s Worked.